DECREASED red wine grape production in the Riverland has followed a recent downward trend.

The 2024 National Vintage Report has revealed grape harvest numbers have continued a declining trend, with the crush result of 1.73 million tonnes falling well below an established 10-year average.

“This is the third vintage in the past five that has been below the 10-year average. As a result, we’ve seen the five-year average decrease by over 100,000 tonnes in the past two years,” Wine Australia manager Peter Bailey said.

“However, the reduction in the crush doesn’t necessarily reflect a decrease in the underlying supply base. There is no indication that the vineyard area has declined significantly, so the potential for a large crop still exists without active management of yields.”

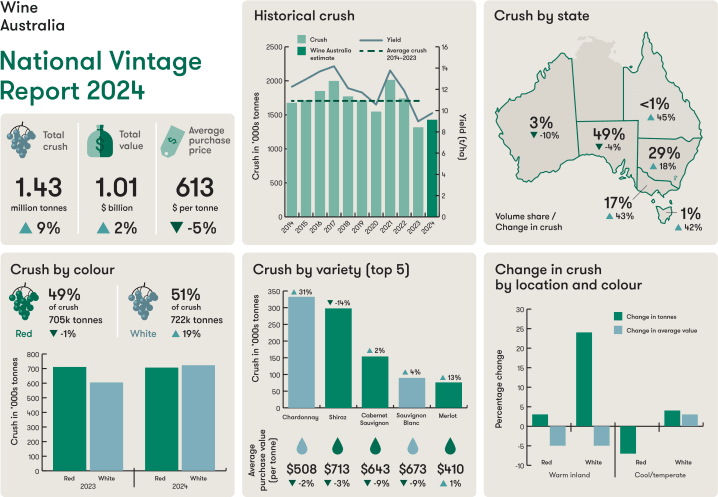

The overall year-on-year increase in the crush was 112,000 tonnes.

The increase was driven entirely by white wine grape varieties, which increased by 19 per cent to 722,000 tonnes. Yet, despite the 19 per cent increase, the white varieties crush was still 10 per cent below the 10-year average and the second smallest in 17 years.

The crush of red grapes declined 1% to 705,000 tonnes, the smallest since the drought-affected 2007 vintage, and 40 per cent below its peak of 1.2 million tonnes in 2021.

The white wine grape share of the crush increased to 51 per cent – the first time since 2014 that the white crush has been higher than the red crush.

“The overall reduction in the red crush is entirely driven by shiraz, which decreased by nearly 48,000 tonnes while most other red varieties increased. This decrease was not just from the inland regions, with the Barossa and Clare Valleys accounting for one-third of the reduction,” Mr Bailey said.

“Seasonal factors have contributed to 2024 being another small vintage. However, the significant further reduction in the red crush can be largely attributed to decisions made by grape growers and wine businesses to reduce production. These decisions are being driven by low grape prices, significant red wine stock overhangs and reduced global demand for wine.”

Shiraz decreased by 14 per cent to 298,000 tonnes – its smallest crush since 2007. However, chardonnay increased by 31 per cent to 333,000 tonnes, overtaking Shiraz to resume the title of largest variety by crush size.

South Australia accounted for the largest share of the national crush size at 49 per cent. All other states except Western Australia increased their crush compared with 2023, with Tasmania increasing by 42 per cent to a record estimated crush of 16,702 tonnes.

The grape crush value of the 2024 vintage is estimated to be $1.01b, a 2 per cent increase over the previous year. This was a result of the 9 per cent increase in the tonnage being offset by an overall decrease in the average value from $642 per tonne to $613 per tonne.

Across the warm inland regions, both reds and whites declined by 5 per cent in average value, while in the cooler regions there was a small increase of 3 per cent in whites, while the average value for reds was flat.

The overall decline in the average value was driven by a decrease in average grape prices paid for both red and white grapes from warm inland regions, combined with an increase in the share of tonnes from these regions.

“It’s important for growers to look at the price changes for individual regions and varieties, to get a true picture of the market signals,” Mr Bailey said.

“However, the overall 2024 results, particularly the ongoing decline in prices for the major inland varieties, indicate that there is no shortfall in supply from the inland regions, despite the successive low vintages.”

To read the full National Vintage Report visit: (www.wineaustralia.com).